A year marked by external and internal challenges

We experienced both internal and external challenges last year. We are in charge of the internal ones ourselves and my focus for the coming year is above all on increasing collaboration between the different parts of the company – the sales organization, production and R&D.

Our performance in the Americas fell well short of our expectations and we saw more cautions market. Region EMEA was negatively affected by the effects on the economy from the Ukraine war. The bright spot has been APAC, which grew strongly with China as the driving force. In R&D we have regained momentum after the pandemic and completed a pilot study in Gut-brain. For the production processes, there is still work to be done in order for them to function optimally and we will continue the work in 2023.

Anita Johansen

“We must improve integration at our sites around the world and increase collaboration and communication so that we are all working towards the same goal to deliver value to our customers.”

Net Sales SEK m

Weaker market in Americas and a couple of customer orders explain the decline vs last year.

Operating profit SEK m

EBITDA margin 2022

The margin was negatively affected by non-recurring items in Q4. Adjusted for that, the margin was about 25%.

Employees

Weaker market in Americas and a couple of customer orders explain the decline vs last year.

The margin was negatively affected by non-recurring items in Q4. Adjusted for that, the margin was about 25%.

Net Sales

SEK m

Net sales

Operating profit

SEK m

Operating profit

EBITDA margin

%

EBITDA margin

Market and products

North America remains the single largest market for probiotic supplements, accounting for approximately 32% of the total market. EMEA accounts for approximately 23% of the probiotic supplement market. Italy is the world's third largest market for probiotic probiotic supplements with sales of 668 USD m. APAC is growing steadily and accounts for nearly 40% of the market for probiotic supplements in 2022. China dominates and is the world's second-largest market.

1:st: USA

2:nd: China

3:rd: Italy

Global sales of probiotic supplements

Region Americas, 32%

Region APAC, 40%

Region EMEA, 23%

Rest of world, 5%

Probi net sales per market

Region Americas, 73%

Region EMEA, 18%

Region APAC, 9%

Probi sales per category

Product sales, 98%

Royalty, 2%

Strategy

Growth for Probi means improved health for more people in the world.

Our goal is to contribute to improved health in people around the world. We do this by extending our portfolio with more products and health areas in more markets.

Probi’s growth target is to grow organically by more than 7% per year. Our largest market is the Americas, while APAC is the most rapidly expanding market. Growth is generated both through new customers and more extensive collaboration with existing ones.

This organic growth must be complemented by long-term strategic partnerships in relevant areas. The partnership with Blis Technologies is a good example where Probi has expanded its portfolio in the rapidly growing area of oral health. Other health areas with great growth potential include vaginal health and gut-brain.

Total growth

Net sales growth YoY Probi 2022

Growth ClinBac™ Americas

Growth of ClinBac™ in region Americas 2022 (excl. the largest customer)

Growth APAC

Net sales growth YoY region APAC

Strategy

Our research in new health areas contributes to a healthier life.

Probi’s scientific roots date back to the mid-1980s with the first patent of the LP299V®. Since then, Probi’s clinical research has resulted in over 400 approved patents in four clinically well documented main areas; digestive health, immune system, bone health and iron absorption.

Probi continuously evaluates new functional areas within probiotics, and in addition to the main areas, research is also conducted in, for example, women’s health, cardiovascular diseases, skincare and mental health. A new area is oral health, where Probi has a research collaboration in the part-owned New Zealand company Blis Technologies.

Number of patents

11 new patents were approved in 2022

New registrations

In 2022, we made six new registrations, two of which were for strains and four product registrations

Investments in R&D

Investments in research and development 2022, corresponding to 7% of net sales

Strategy

Internal manufacturing creates flexibility and business opportunities.

Probi is one of the few fully integrated players on the market with its own advanced production of probiotics.

By having its own production capacity, Probi has control over its most important raw material. It also means that Probi has internal expertise and can continue to develop its innovative manufacturing, which creates efficient business processes and strengthens competitiveness in the long term. Probi can offer a wide range of products and make quick adjustments to changes in the market by having full control over the process from fermentation to final format.

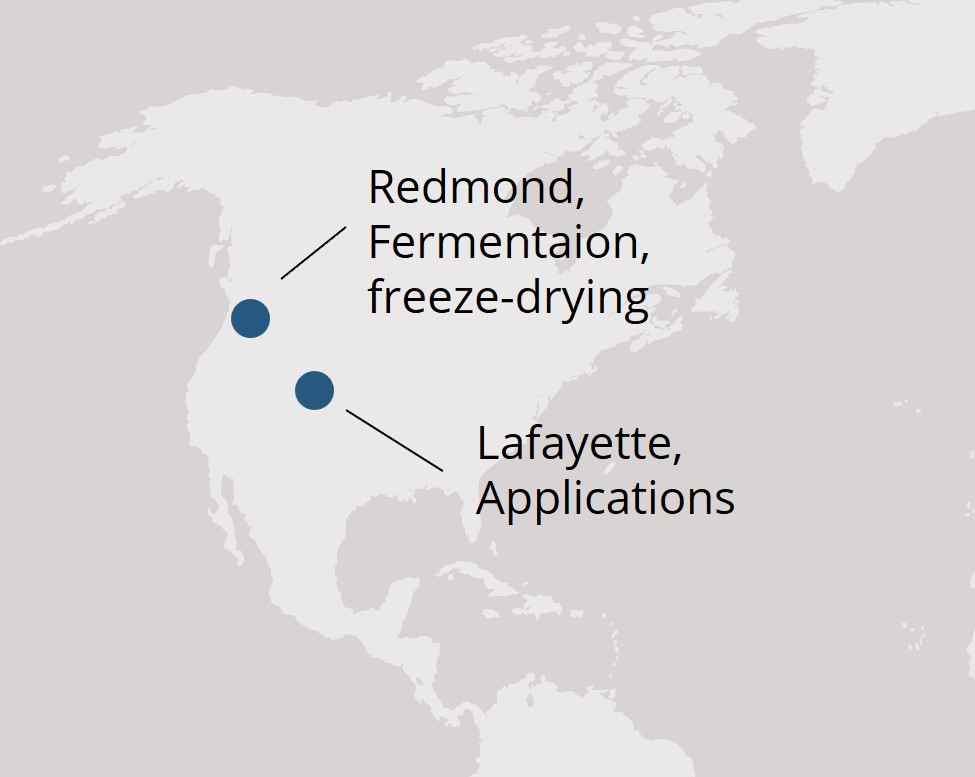

Manufacturing facilities

Probi has two production facilities in the USA, in Redmond, Washington and in Lafayette, Colorado

Our vision is to improve the health and well-being of people around the world

The starting point of Probi’s new sustainability strategy is the company’s vision to improve the health and well-being of people throughout the world. In Probi’s day-to-day work – from probiotics research to manufacturing and new collaborations – a significant part of the sustainability work already takes place.

The aim of the strategy is to ensure that sustainability efforts take place in all parts of the business and as strategically as Probi’s business development in other spheres.

The work on sustainability in three key areas, in which Probi has set ambitions, targets and an action plan.

Number of countries in which Probi's products are sold

With establishment in more markets, Probi contributes to increased prosperity in the world through sales of clinically documented probiotics.

of addressed suppliers signed the Code of Conduct

By 2025, all our suppliers will adhere to the established principles of safety, security, diverse and inclusive environments for employees.

Increased CO2 emissions

We increased our CO2 emissions by 8% in relation to produced probiotic culture in kg. Our ambition is to halve CO2 emissions throughout our value chain by 2030.

Gender distribution

Men, 48%

Women, 52%

Gender distribution, managers

Men, 49%

Women, 51%

Gender distribution, executive mgmt

Men, 67%

Women, 33%